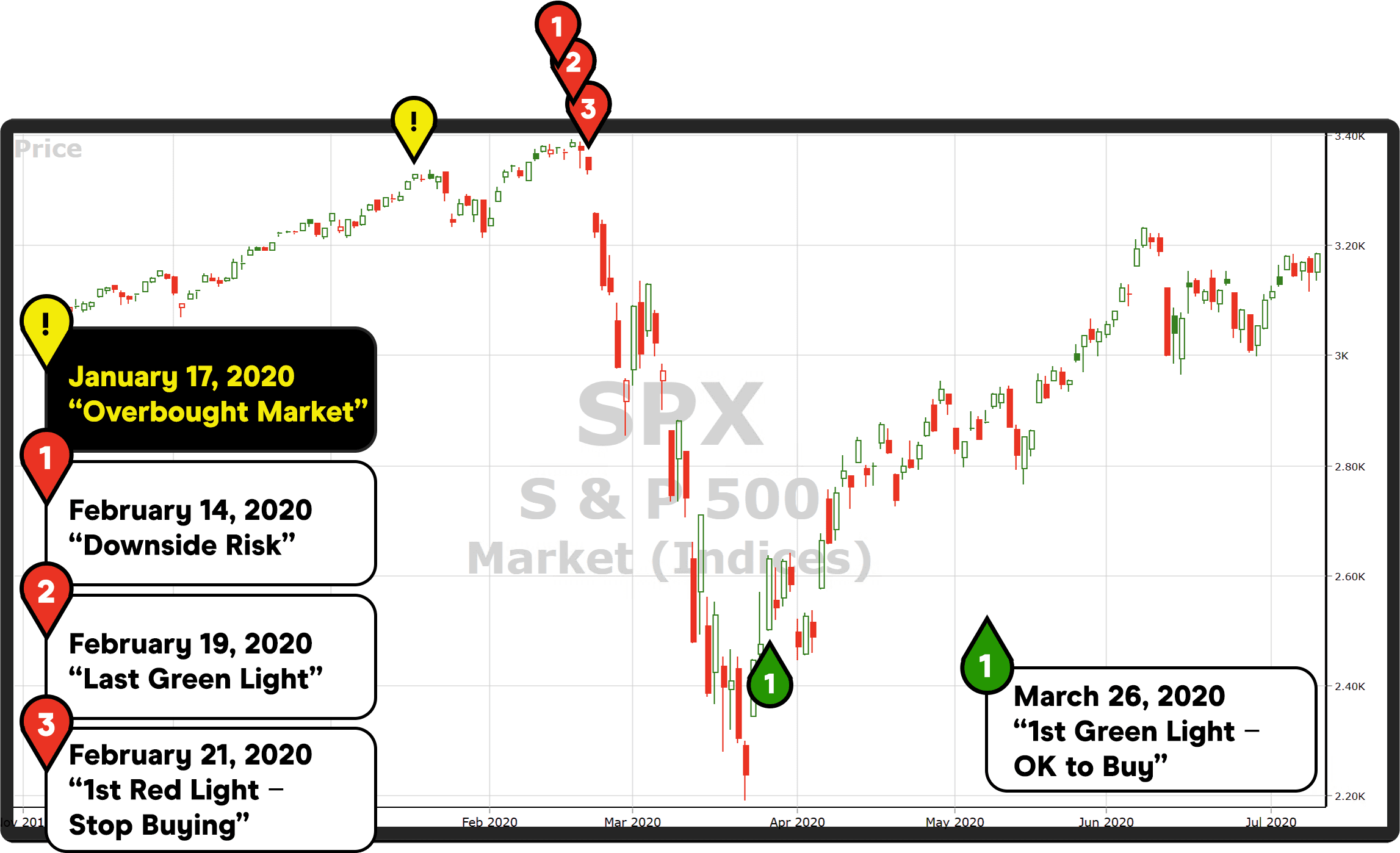

Your Entry Signal

Stop trying to nail the bottom. You are attempting the impossible!

Instead, use a signal that tells you the market is trending UP & it’s ok to buy.

Institutions use moving average crossovers.

However, they tend to be slow, and many times have you buying while the market is falling.

Here at VectorVest, we use a proprietary signal that is:

The Big Mistake

Most investors are taught it all wrong.

You were probably taught:

The market always goes up, so buy and hold.

You can't time the market, so it's always a good time to buy.

When stocks go down, it's a buying opportunity.

That advice leads to disastrous consequences.

The stocks you buy tend to drop right after you buy them.

A portfolio rollercoaster ride — slow moves up and fast moves down.

The drops in your portfolio take years to recover from.

The BIG MISTAKE is IGNORING MARKET DIRECTION.

Ignoring the market can inflict a financial and emotional toll on you. Some investors never recover and leave the market for good.

The Most Important Factor

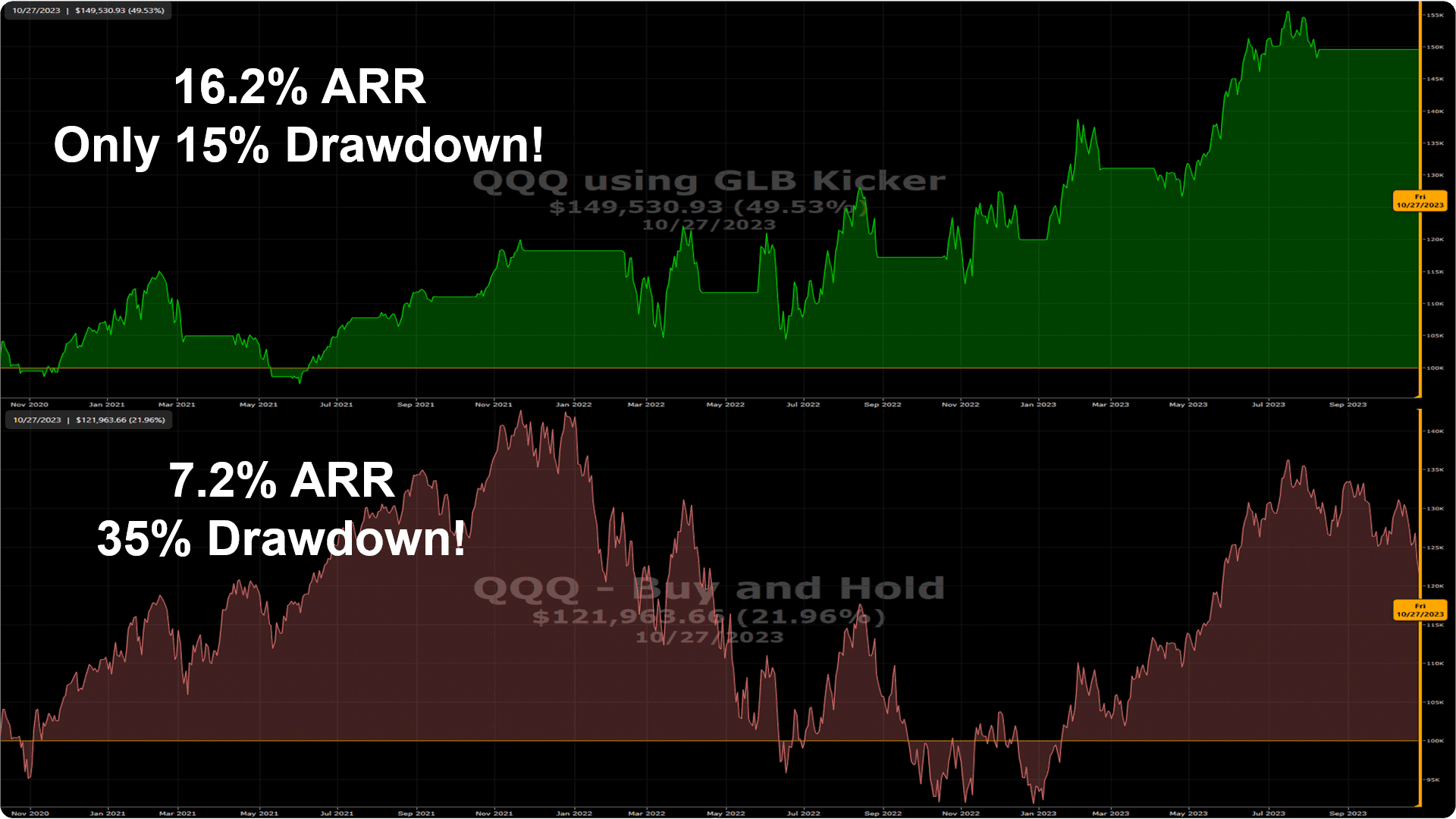

The COVID Drop

Here’s a closer look at the COVID drop.

Those who followed the buy and hold strategy saw their portfolio drop 34% in one month and spent another five months making back losses.

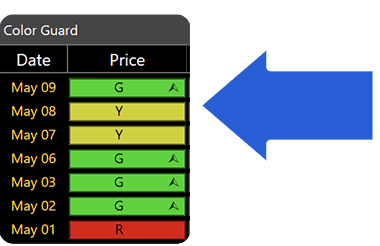

Our last buying signal occurred on February 19th.

No green lights appeared for the entire duration of the collapse.

Three days after the market bottomed, our first green light buy signal appeared.

You avoided the drop and reaped the rewards of the strongest rally in over 70 years!

Give it a try for yourself. Start your 30-day trial to VectorVest today.

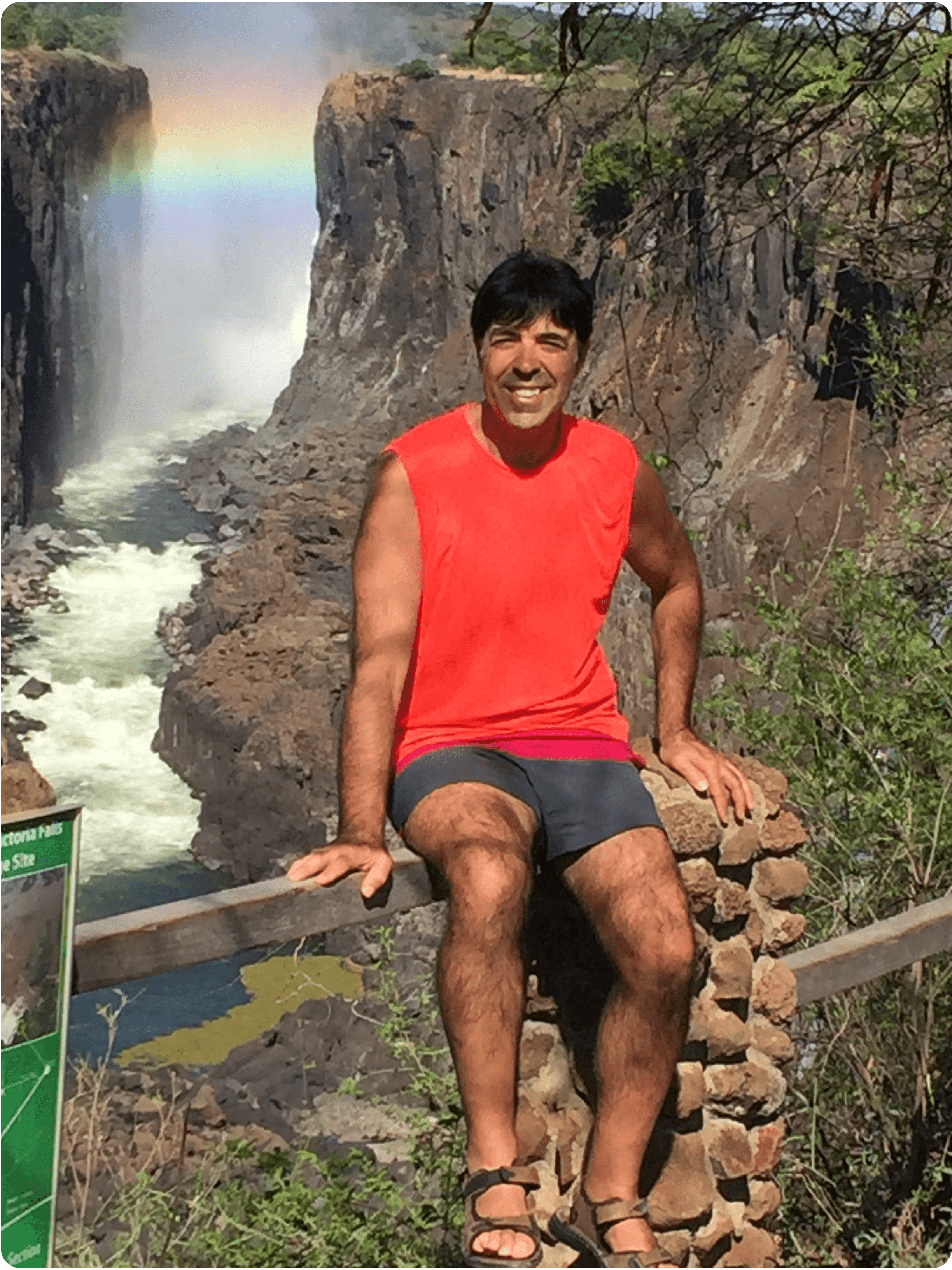

Kamel C shared his experience with us.

“After 25 years as an entrepreneur, I retired and needed to grow my account in the stock market. Prior to my VectorVest training, my experience in the market was awful. I think I did everything wrong. I would buy falling stocks, in down markets and on down days. Most of the stocks fell and I would just HOPE they would come back. Eventually, I started to question my ability to continue investing.

After taking the training from VectorVest, I set up a daily routine which only takes about 30 minutes. In my first year, I took four portfolios, and each was up over 23%. The following year it continued, and my portfolio is up over 20% with about ½ the year to go!

I've now been able to automate many of my tasks and my emotions are minimal. I have no stupid actions anymore! I like to travel several times a year, sometimes for extended periods. Knowing I'm in total control of my accounts and can manage them in just a few minutes each day, provides me with peace of mind.”

Strategic Shift

The journey to becoming a successful investor involves making a strategic shift. You need to shift from ignoring market direction, using a “buy & hope” philosophy which causes a portfolio rollercoaster ride to where you buy at the right time, using a buying signal which allows you to see a steady climb in your portfolio.

Timing the market using a buying signal is one part of your system and it is needed to become a successful investor.

Now that you know what stocks you want to buy and when to buy them, you’ve got to know how to sell them at the right time. In our next training, we’ll look at “How to Know When to Sell.”